From Classrooms to Boardrooms: Goizueta’s Hands-On Journey in Impact Investing with the MIINT Program

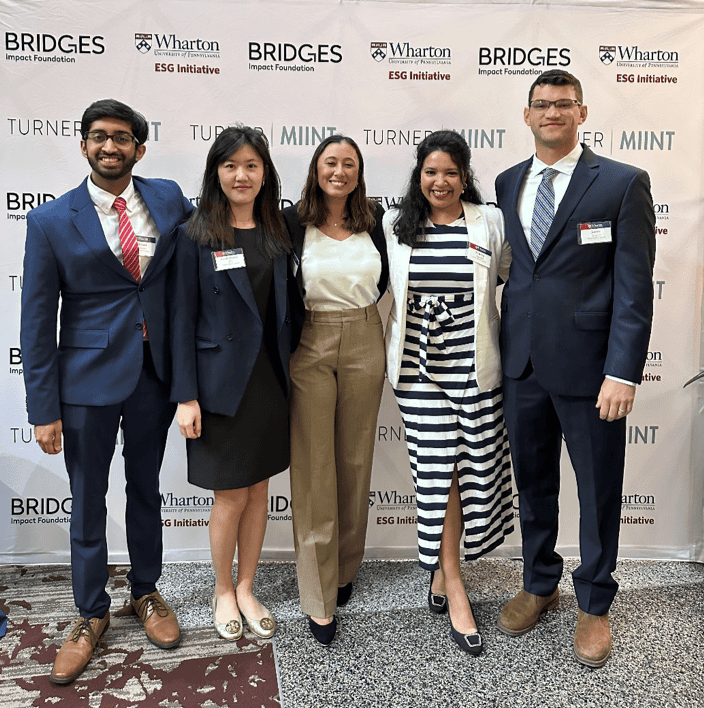

According to the Global Impact Investing Network (GIIN), the impact investing market is approximately $1.5 trillion. Impact investments are made with the intention to generate positive, measurable social and/or environmental impact alongside a financial return. Investors are increasingly recognizing the importance of ‘system-level’ solutions to address interconnected global risks, driving positive change in the industry. A noteworthy educational initiative in this space is the Turner MBA Impact Investing Network & Training (MIINT) program, a collaboration between the Wharton Social Impact Initiative and the Bridges Impact Foundation. This six-month program provides graduate students with hands-on experience in early-stage impact investing, including creating investment theses, sourcing deals, conducting due diligence, and presenting to an investment committee. Last year, I led Emory University Goizueta Business School‘s team in the Turner MIINT program. It was a rewarding extension of my Full-Time MBA experience, gaining practical skills to think like early-stage impact investors.

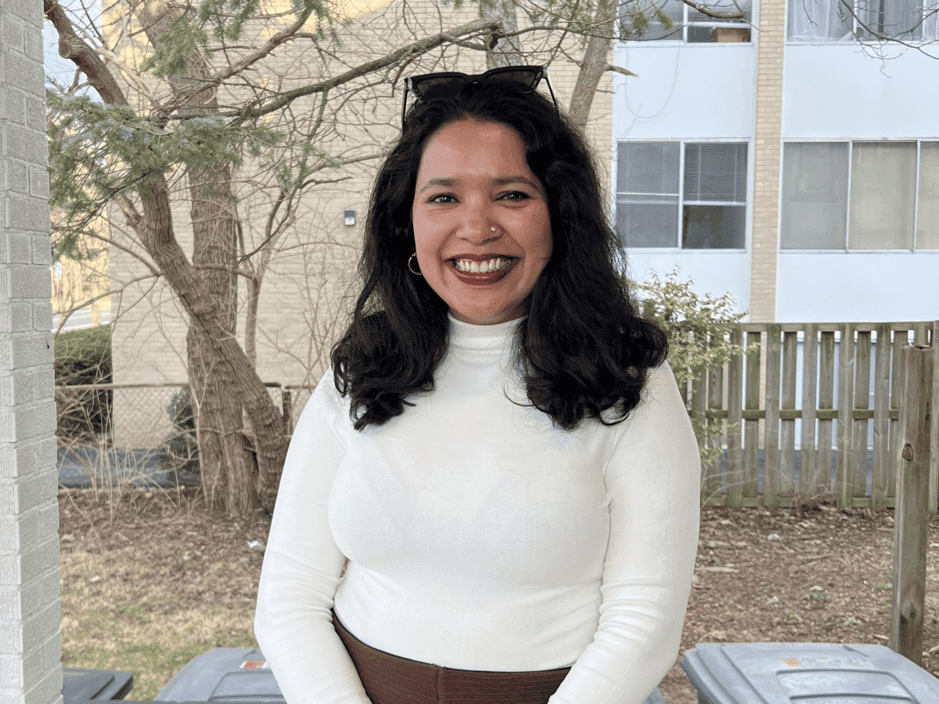

To represent Emory, the Goizueta Impact Investing (GII) Club assembled a diverse team from various programs, including MBA, MPH, MD, and Master of Finance (MF). This diversity brought together a range of expertise in healthcare, consulting, finance, social entrepreneurship, and investing, allowing us to fully represent Emory’s strengths. Our journey started with Goizueta’s deep-rooted connections to both local and global startup ecosystems, uniquely positioning us to source impactful opportunities, particularly in Atlanta and the Southeast US. Throughout the sourcing process, we met several inspiring founders and had the privilege of hearing their stories and visions. Understanding how their work aligns with community needs and identifying realistic impact metrics were critical aspects of our decision-making. It was a humbling experience that showcased the growth of the entrepreneurial landscape in the South. MIINT’s curriculum guided us in assessing systemic risks and understanding how to measure impact at different growth stages. I believe the process of sourcing gave us a valuable overview of how to think about the depth, breadth, and probability of success.

After careful consideration, we selected Betty’s Co, a pre-seed startup founded by Jennifer Newell that integrates gynecology, mental health, and wellness services for young women through boutique mobile clinics and a user-friendly app. Jennifer’s entrepreneurial journey is incredibly inspiring, and her determination to make a difference in young women’s healthcare is remarkable. We really enjoyed working with Jennifer and her team.

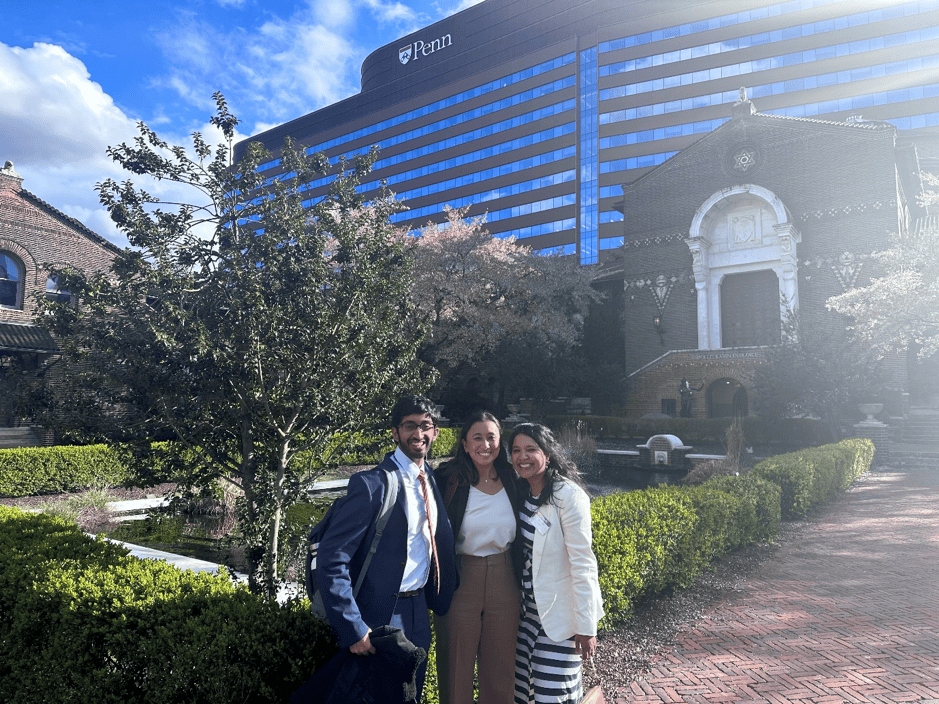

In April of this year, we flew to The Wharton School to deliver the final presentation. This time, breakout rooms were divided by industry, and we were categorized under the Healthcare sector. We got lucky when Bobby Turner, CEO of Turner Impact Capital and a key sponsor of Turner MIINT, entered our room just as we were next in queue. He sat through our presentation and left us a note saying, ‘Great Job.’ It was such a sweet gesture and made us so happy. This recognition showed the hard work and teamwork of my amazing teammate. My favorite memory from the trip is the team rehearsing right after arriving at the Airbnb, enjoying Chinese food, and waking up early the next morning for a few more practice rounds.

Looking back, my introduction to impact investing began in Professor JB Kurish‘s class on Social Entrepreneurship and Impact Investment (offered by Goizueta’s Business & Society Institute), which highlighted the evolving role of businesses in driving societal impacts. These lessons were put into practice during my independent study with a social enterprise called Jackfruit Finance, a tech-enabled lender in Kenya focused on providing affordable financial solutions to schools. As a part of the study, I developed investment materials for the company. The experience, running parallel to MIINT, complemented my learning perfectly, deepening my understanding of impact investing. As a social enterprise fellow, I’m grateful for all the opportunities I gained during my time at Emory. One thing is for sure: impact investing is an exciting field, and beyond all the buzz, it is a real and growing sector.

References: GIIN, Turner Miint

Interested in exploring Full-Time MBA opportunities? Learn more about Goizueta’s Full-Time MBA program.